Understanding and complying with local regulations is essential for Airbnb hosts to avoid legal issues, maintain a good relationship with neighbors, and ensure a smooth operation. Each city, town, or country may have its own set of rules regarding short-term rentals, and failing to adhere to these regulations can result in fines, penalties, or even a ban on hosting. Here’s what you need to know to navigate local regulations effectively.

1. Research Local Laws and Ordinances

Before listing your property on Airbnb, it’s crucial to thoroughly research the local laws and ordinances governing short-term rentals in your area. These regulations can vary widely depending on your location, and they may include restrictions on the number of days you can rent out your property, requirements for obtaining permits or licenses, or specific zoning laws that determine whether short-term rentals are allowed in your neighborhood.

2. Understand Zoning Requirements

Zoning laws dictate how properties in different areas can be used. In some cities, certain zones are designated for residential use only, meaning short-term rentals may not be permitted. Other areas may allow short-term rentals but require hosts to obtain special permits or meet certain conditions, such as limiting the number of guests or ensuring that the property is owner-occupied. Understanding your property’s zoning classification is a key step in determining whether you can legally operate an Airbnb.

3. Obtain Necessary Permits and Licenses

Many jurisdictions require Airbnb hosts to obtain specific permits or licenses to operate legally. This might include a general business license, a short-term rental permit, or even health and safety inspections to ensure your property meets local standards. The application process can vary, so it’s important to contact your local government or visit their website to find out what’s required. Failing to secure the necessary permits can result in fines or the suspension of your Airbnb listing.

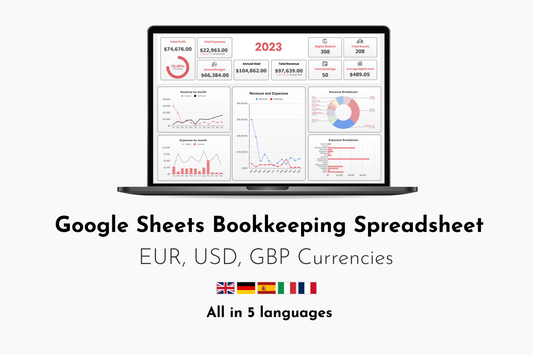

4. Comply with Tax Obligations

As an Airbnb host, you may be required to collect and remit taxes on your rental income. This can include occupancy taxes, hotel taxes, or other local levies that apply to short-term rentals. Some jurisdictions require hosts to register with tax authorities and submit regular tax filings. Airbnb often facilitates the collection and remittance of these taxes, but it’s still your responsibility to understand your tax obligations and ensure compliance. Keeping accurate records of your income and expenses is essential for tax reporting.

5. Follow Health and Safety Regulations

Health and safety regulations are designed to protect guests and ensure that your property is safe for short-term stays. These regulations may include requirements for smoke detectors, carbon monoxide detectors, fire extinguishers, and clear emergency exits. In some areas, you might also be required to conduct regular inspections or adhere to specific cleaning protocols. Meeting these standards not only helps you comply with local laws but also ensures the safety and well-being of your guests.

6. Be Aware of HOA Rules

If your property is part of a Homeowners Association (HOA), you’ll need to review the HOA’s rules regarding short-term rentals. Some HOAs have strict regulations or outright bans on short-term rentals, while others may allow them with certain restrictions. It’s important to obtain written approval from your HOA if required, as violating HOA rules can lead to fines or legal disputes with your neighbors.

7. Respect Occupancy Limits

Local regulations often set limits on the number of guests who can stay in a short-term rental property at one time. These limits are usually based on the size of the property, the number of bedrooms, or local fire codes. Exceeding these limits can result in fines and may also create safety hazards. Clearly stating the maximum occupancy in your Airbnb listing and ensuring that guests adhere to it is essential for compliance.

8. Monitor and Adapt to Regulatory Changes

The legal landscape for short-term rentals is constantly evolving as cities and towns respond to the growing popularity of platforms like Airbnb. Regulations can change quickly, and what is legal today might not be tomorrow. Stay informed about any proposed changes to local laws and be prepared to adapt your hosting practices if necessary. Joining local host groups or associations can be a helpful way to stay up-to-date on regulatory developments and share information with other hosts.

9. Engage with Local Community

Maintaining a good relationship with your neighbors and local community is crucial for long-term success as an Airbnb host. Being respectful of noise levels, parking, and other community standards can prevent conflicts and complaints that might lead to regulatory scrutiny. Additionally, consider participating in local discussions or meetings about short-term rentals to better understand community concerns and contribute positively to the conversation.

10. Consult with a Legal Professional

Given the complexity of local regulations, it may be wise to consult with a legal professional who specializes in short-term rental law. A lawyer can help you navigate the legal requirements, ensure your contracts and agreements are in compliance, and advise you on how to protect yourself from potential legal issues. While this may involve an upfront cost, it can save you from costly mistakes in the long run.

Conclusion

Understanding and complying with local regulations is a critical aspect of being a successful Airbnb host. By thoroughly researching local laws, obtaining necessary permits, adhering to tax obligations, and maintaining open communication with your community, you can operate your Airbnb legally and responsibly. Staying informed and proactive in your approach to regulations will help you avoid legal pitfalls, ensure a positive experience for your guests, and build a sustainable hosting business.